In which French regions does Harmony invest ?

Traveller relations

When considering purchasing shares of properties intended for seasonal rentals, the first question that comes to mind is: where to invest? The choice of the market, i.e., the geographical area in which you are looking for properties, is a critical decision that can have a significant impact on your success in the project, both in terms of enjoying your right to occupancy and rental returns. Harmony, the first platform that facilitates the purchase of shares in short-term rentals, takes this crucial question into account. The choice of the market will subsequently determine that of the neighborhood, and ultimately, the property's quality for travelers and its yield. In this article, we will explain how Harmony selects the properties listed on its platform, starting with the choice of the market.

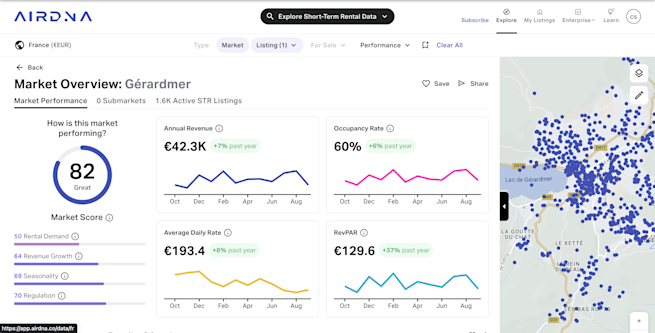

Market Analysis with AirDNA

To assess potential markets, Harmony relies on AirDNA, the leading company in short-term rental analysis and data. AirDNA collects data from thousands of sources, such as Airbnb, Abritel, and Vrbo, to build a comprehensive overview of the short-term vacation rental market. This data also includes information from 50,000 private hosts and strategic API partnerships with major property management companies. AirDNA thus compiles data from Airbnb and Vrbo to gather information on more than 10 million short-term rentals in 120,000 cities worldwide.

To evaluate a specific market, AirDNA uses a market score based on four key indicators:

1. Rentals Demand

AirDNA examines how often rentals are booked throughout the year. By using the annual occupancy rate and growth rates of listings, this score reflects the relative demand for travel in a given market. A high score signifies high travel demand, which is a positive indicator.

2. Revenue Growth

AirDNA analyzes whether vacation rental listings in an area have generated more revenue compared to the same period the previous year. Revenue growth indicates a dynamic and attractive market for investors.

3. Seasonality

Seasonality is essential in the vacation rental sector. AirDNA assesses how much travel demand varies between the high and low seasons. A market with low seasonality is generally more stable.

4. Regulation

Regulation plays a crucial role in the viability of a market. AirDNA examines local regulations to assess whether they are favorable or restrictive for investors. Markets with low or loosely enforced regulations are more attractive.

The AirDNA market score is calculated based on the percentile in which the market ranks compared to the top 2,000 Airbnb markets worldwide. This score is updated monthly, providing a valuable indicator of market trends.

Other Selection Criteria

In addition to the score derived from real rental data analysis, Harmony uses a set of criteria to identify markets with attractive characteristics for vacation rental investments. Here are some of the key factors considered:

Potential Returns

The potential returns from vacation rentals are a crucial criterion. Harmony analyzes historical data and current trends to estimate expected returns in a given market by comparing the cost of homes to the average income from short-term rentals. A good investment opportunity is characterized by affordable property costs and strong rental income.

Municipality

In addition to regulations, Harmony assesses whether the municipality welcomes the establishment of new seasonal rentals to promote tourism. Knowing whether the municipality actively contributes to the residents' quality of life (roads, playgrounds, infrastructure) is essential. It is also important to consider the local policy on property tax for second homes.

Quality of Life

Quality of life is an essential element in attracting visitors. Inherent elements of the location, such as the presence of a seaside resort, a ski resort, a historic monument, a theme park, are taken into account. But Harmony also closely examines quality of life indicators, such as safety, amenities, leisure activities, local culture, and economic stability.

Transportation

Harmony evaluates markets where transportation infrastructure is accessible and well-developed, facilitating the movement of visitors to vacation rental properties. Transportation expenses are a determining factor for travelers. Therefore, areas close to major urban centers are favored for seasonal rentals.

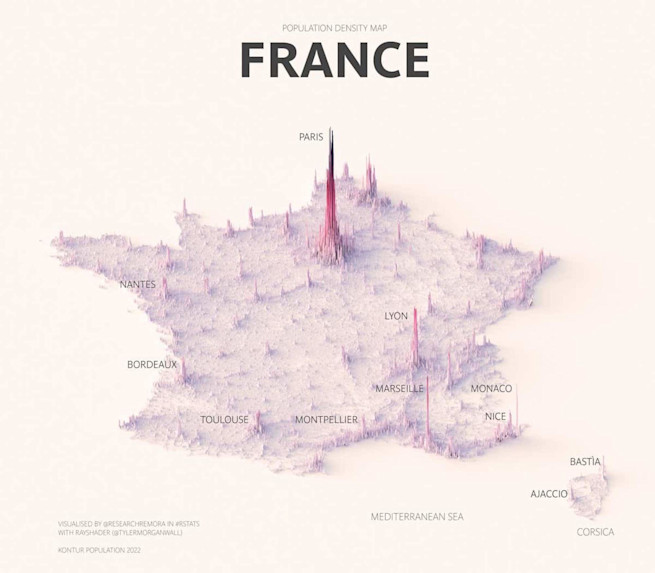

Top Investment Zones

Harmony has identified several promising geographical areas for vacation rental investments in France. These include, from north to south:

Côte d'Opale and Dunes de Flandre

Côte Fleurie in Normandy and its hinterland

Tourist resorts in the Vosges

French Alps

Provence and natural parks (Lubéron, Alpilles, Cévennes)

French Riviera

Mediterranean Coast in Occitanie

These regions are selected based on their potential for returns, attractiveness to travelers, and their alignment with the criteria mentioned above.

Conclusion

The choice of the market is a crucial step in vacation rental investment. Harmony relies on meticulous market data analysis, rigorous selection criteria, and AirDNA's expertise to identify the most promising markets. By investing in carefully selected properties, you have the opportunity to enjoy these properties and generate stable income to maximize your return on investment.

As a member of Harmony, it is essential to understand how these factors influence the profitability of a market. With strong partnerships, reliable data, and in-depth expertise, Harmony strives to offer attractive opportunities in the most sought-after regions for vacation rentals.

Remember that the market is dynamic, which is why continuous data monitoring and adjusting your portfolio are essential to maximize your success as a purchaser of vacation rental shares. With Harmony, you have a trustworthy partner to guide you on your journey.

Feel free to explore the opportunities offered by Harmony and make informed decisions based on carefully selected markets. Your next purchase of shares in a real estate property may well be in one of the privileged regions identified by Harmony.