Fragments review: read this before you invest

Traveller relations

March 2025 update on the Fragments situation: financial difficulties and future scenarios

The Prello Group and Fragments have announced that they are going through a period of serious financial difficulties. A receivership procedure has been initiated, with an opening hearing taking place on February 5, 2025. As a result, Fragments has had to cease its rental management activities on the properties financed in Blois and Dijon. Two scenarios are now envisaged: either a resumption of management activities by a buyer, or a partial liquidation of the assets to enable the bonds to be redeemed. Further information will be provided as the situation develops.

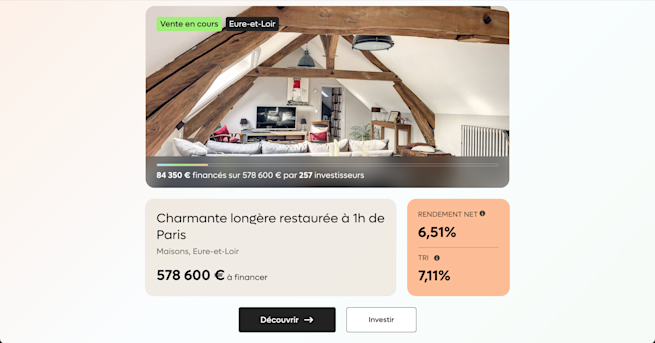

Fragments is a French fractionnal real estate platform that does not feature English content, making it very difficult for someone not speaking French to invest.

By the numbers - Fragments

Minimum Investment | €50 |

Investment Holding Period | 8 years |

Early Withdrawal Penalties | 3% |

Rent Payout Frequency | Quarterly |

Average Yearly Returns | Unknown |

Right of Enjoyment | None |

Should You Invest with Fragments?

Fragments is still a young company, and it remains uncertain whether the promised performances will be realized. While its user-friendly and accessible platform seems promising, Fragments does not allow investments via legal entities, has not yet implemented a secondary market for enhanced liquidity, and the platform's fee structure appears to lack transparency.

Pros and Cons

Pros | Cons |

✨ User-Friendly 🏠 Investment in short-term rentals 💶 Low minimum investment | 🔦 Lack of transparency regarding fees 🏢 Excludes legal entities 🙅 No right of enjoyment |

Why We Wrote This Guide

Deciding where to invest your money is a complex task. Stocks, PEA, life insurance, ETFs, bonds, and even cryptocurrencies have a place in the modern portfolio, but real estate has always been a preferred asset class among investors, despite being somewhat misunderstood. In recent years, several companies have emerged, claiming to simplify real estate investment by eliminating initial down payments, increasing liquidity, and dividing properties into fractions. In such an environment, knowing whom to trust and what you're truly committing to when you invest has become more challenging than ever.

We have analyzed Fragments by delving into key areas that investors need to understand before fully committing: ease of investment, potential earnings, and how to retrieve your money once you've achieved the desired returns.

Note: For transparency, we are Harmony, one of these new real estate companies. Harmony allows the purchase of shares in properties intended for short-term rentals. We believe that healthy competition and market growth will benefit everyone. In this context, providing a fact-based analysis of other companies in the real estate industry through the lens of our sector expertise serves both consumers or investors and the companies providing them with a service. That being said, we do not aim to provide personalized investment advice or recommendations.

FINAL THOUGHTS

Is Fragments a good investment?

Fragments is a viable option for inexperienced investors looking to get involved in real estate with minimal understanding. Currently, Fragments does not allow investments through legal entities, and the platform has not yet developed a secondary market to enhance liquidity.

The fractional investment system and Fragments' service are user-friendly and easy to use, with attractive minimum investment amounts. However, the lack of transparency regarding "frais de chasse," additional commissions at the time of property purchase, is a drawback. Announcing these fees would have demonstrated greater transparency. We will have to monitor the projects listed to see if the company's optimistic assumptions hold up in reality.